Investor Alert

Top Ten Investment Mistakes

Stock Market Carnage - Are Your

Investments Safe?

Under the Microscope: Focus on Lifestyle

or Target-Date Funds

Financial

Follies: Bank Deposit Rates VS. Money Market Funds

Auction Rate Securities

Preventing Identity Theft

Biggest Investment Scams

According to State Securities Regulators

N.A.S.D.

Disclosure Plan

Flirting

With Disaster

NASDAQ Bulletin

Board and Pink Sheet Stocks

Scams and

Frauds

Protecting

Yourself From The Most Common Scams

Stock Market Carnage -

Are Your Investments Safe?

How did this happen?

Greed created bubbles in real estate, housing, banking and brokerage. The

problem was exasperated by the management of these financial institutions.

Rather than immediately acknowledge the potential negative developments and be

proactive in raising necessary capital and reducing expenses, most bank

executives totally underestimated the problem or worse yet, totally ignored it.

Banks like Fifth Third Bank, based in Cincinnati, Ohio, actually increased their

dividend early last summer, showing a total disregard toward the financial

environment unfolding around them. Last month, in an all too typical reactive

move, Fifth Third raised capital after the stock had already plunged toward

single digits and - oh yes, you guessed it – dramatically cut the dividend they

recently raised. Last year they could have easily raised capital from a position

of strength rather than the dilutive moves many banks are currently pursuing. We

do not mean to single out Fifth Third, because so many financial institutions

failed to act. Unfortunately this failure to act will extend and broaden the

ripple effects from this credit crisis, which means that investors should

continue to maintain a very selective, cautious approach. Rising energy and food

costs, the negative wealth effect and plunging consumer confidence all will

provide difficult headwinds for equities.

Last summer when subprime first hit investors’ radar, we were concerned that

investors were not fully cognizant of the ramifications and ripple effects of

these subprime loans. Many experts on television were quoting how total subprime

loans were such a small fraction of the overall U.S. economy. It is this drastic

underestimation of the ripple effects, combined with the slow reaction of CEOs

of U.S. financial companies in raising capital, that will prolong and intensify

this crisis to a greater degree from what we even expected. The balance of the

year, Lehman Brothers and Washington Mutual are two further names that need some

drastic restructuring now that Fannie and Freddie have their rescue plans

coordinated. In addition, many financials will face much greater scrutiny with

their year end audits. The markets will be facing all of this with the

uncertainty of a presidential election, dramatically slowing economics in the

emerging markets and the likelihood of recessions in much of Europe. On the

positive side, valuations in some industry leaders are becoming fairly

attractive.

In addition, many areas of the country are still going to experience

significantly lower real estate prices that have yet to be adjusted on bank

balance sheets. In the United States alone there is over $1 trillion of

outstanding home equity loans and as homeowners fall to negative equity, these

loans hit the lenders by immediately turning to unsecured from secured loans.

When you combine this with the disturbing trend of growing vacancies in

commercial real estate and heavy exposure in unsecured construction loans, it is

no wonder investors are finally taking our words of warning to heart, even

though it may have been a much procrastinated response! In addition, banks do

not have nearly the loan-loss reserves that they enjoyed before accounting rules

changes after the Enron scandal. This leads us to believe that it will take at

least 2 – 3 more quarters before the financial clouds begin to lift and a total

assessment of the damage can be made.

Rebalancing

Many investors are now laden with numerous positions (how about 138 positions

for an account of approximately $700,000) under a separate account management

program or asset allocation accounts with a vast cross section of mutual funds

representing practically every asset class known to mankind. Both of these

programs do offer diversification and are superior to the concentrated

portfolios of eight years ago, but they do not offer much more than riding the

market’s volatile swings – in both directions. It seems like many investors were

sold on this concept that the rebalancing of one’s portfolio would lessen risk

and help avoid those periods of major losses. Rebalancing may act as a buffer in

a declining market when done properly, but these auto-rebalancing programs done

by asset allocators are flawed and that is why we are seeing so many of these

new accounts coming in, very concerned about their losses.

Rebalancing is a process that must be monitored daily and not automatically done

at certain intervals, like once or twice a year or even quarterly. For example,

if you rebalanced at the end of last quarter, you would have sold some bonds or

bond funds and placed those proceeds in equities like the S&P 500 stock index.

This sounds smart because bonds have outperformed stocks and you’re taking some

profits in bonds to buy stocks near their lows. The problem comes in when you

look at the equity component. Energy’s bubble has increased that sector’s

exposure in the S&P 500 from only 6% eight years ago to over 14% on 6/30/08. So

by rebalancing back into equity, you are adding to an already high weighting in

a frothy sector. Proactive money managers and advisors were locking in gains in

energy, not chasing these high flyers at the time. The same examples can be made

for each of the aforementioned bubbles. Investors in both individual positions

and mutual funds should rebalance continuously based on market swings rather

than some arbitrary date. In October 1987 when the D.J.I.A. lost 22% in one day,

if you would have waited to rebalance until the mid-point of the following year,

you would have missed out on all but the last 100 points of the recovery.

Many inactive or passive accounts have unrealized losses of hundreds of

thousands of dollars, and sadly, had the trust department reduced weighting in

that sector, these losses could have been materially avoided. What to do now?

You will hear more and more talk about raising cash in the weeks to come, but

the time to do it was one year ago when the S & P 500 hit a record high, or

earlier in the summer of 2007 when there were plenty of warning signs that

financial markets were heading out of control. The reactive methods utilized to

fix the credit problems will not only take much longer to take hold (because of

the procrastination), but may in turn establish a new set of problems of which

we are unaware. We are still seeing too many investors taking excess risk in

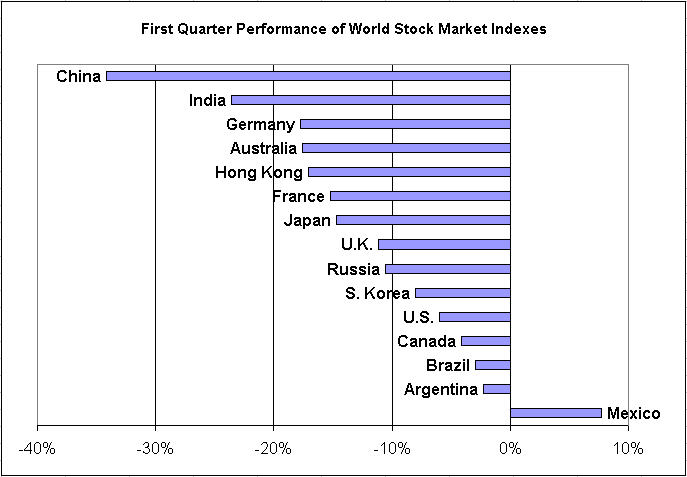

emerging and international markets, and would recommend a significant

under-exposure in the area, as many of their problems will take even longer than

America’s to remedy.

When you can reduce risk and improve long term performance, you have the best of

both worlds but investors must be proactive to take advantage of such extremes

and volatility. Once again, following the herd and chasing the much-loved

financials one year ago proved to be a tough lesson for the average investor to

learn. These markets are so volatile that it will continue to be critical to

remain disciplined and take advantage of the swings in both directions, but

selectively buying into current sizeable weakness seems prudent.

For the past decade investors have just jumped from one investment category to

another, chasing performance without taking into consideration any measure of

risk. For ten years now, passive investors are showing a lost decade of no gains

whatsoever in the S&P 500. Investors who chased performance have suffered

startling negative returns, but investors who have utilized these extremes to

their advantage by strategically taking profits, avoiding the tech/internet

craze in 2000, the housing and real estate bubble and the more recent emerging

markets and commodity bubbles have done well with a far lesser degree of risk.

Which brings us to what may turn out to be one of the most expensive sources of

the problem, and that is the lack of direction by many advisors. Here are some

of the biggest mistakes and most costly errors we have seen with the recent

market turmoil as well as over the past three decades:

1. Complacency - We've lost count of how many times new clients have told us

their advisor did nothing during events like what we have experienced since last

summer. If statements like "be patient, the market will come back" or "you are

diversified, don't worry" ring familiar, it has most likely proved costly to

your portfolio.

2. Costs - we are still seeing large accounts - many of which are taxable - that

are in mutual funds or separately managed accounts (SMAs) with high costs. In

many cases, the unsuspecting investor is not even aware of the total cost of

their investment program. Investors must factor in annual expense ratios,

commission costs, and any front end loads & 12b-1 fees just to get an idea of

the costs behind their investments. Keep in mind that according to Lipper, your

after-tax return was reduced by anywhere from 17-44% over the past decade due to

taxes alone.

3. Risk - everyone likes to talk performance but a key to long term success is

to ascertain, and limit, risk prior to making every investment. This includes a

daily assessment of risk, not periodic rebalancing or over-diversifying into all

asset classes, which may sound good, but falls short in volatile global markets.

Arbitrary rebalancing is a reactive, novice measure to reduce risk in these

volatile markets and investors hoping to limit risk by investing in a broad

range of asset classes have learned this past year how interrelated such asset

classes can become. We have never understood why an investor would want to hold

financial stocks from their all time highs during the summer of 2007 or

technology stocks at ridiculous valuations during the start of this decade.

Two Things Investors Should Learn From the Current Financial Turmoil:

1. Spreading risk does not eliminate, or even limit, risk during volatile

markets. This is true at all levels from asset allocation strategies to complex

derivative securities. If it is a risky asset to begin with, it will be risky in

combination with other assets, no matter what Wall Street tells you.

2. During volatile times it is critical to be proactive, rather than reactive.

It is definitely easier to do the latter and follow the herd, but investors must

learn to continually monitor and reduce risk on an ongoing basis - not just

periodically.

We felt that the damage of these excesses would

have been completed by the beginning of the fourth quarter,

making it an excellent buying (or entry) point. However, the

delays and slow reaction regarding the credit crisis have

prolonged and intensified the global problem. In fact, we have a

near perfect storm of events that have exasperated the credit

crisis - from the political delays in doing something about it

to the liquidations and force selling by hedge funds. Add to

that the dramatic slowdown and lost global growth catalyst from

the BRIC countries, the crisis of confidence in both the global

financial market as well as regarding the consumer, who has been

so instrumental in supporting the economy, and investors begin

to understand the extent of our problems. It will take more time

for the financial clouds to lift and the general market will

still have difficulty establishing worthwhile new highs until

this occurs. The extreme downside volatility has brought

valuations to more attractive levels, but during times like

these the pendulum usually swings to extremes. Investors are

just beginning to understand the complexity in the massive

leveraged excesses over the majority of this decade.

What to ask your advisor

Since many advisors sound so authoritative and knowledgeable to the average

investor, it is very important for investors to be able to cut through the

broken-record spiel advisors give regarding their fees and investment style.

Below are some things you should know before deciding on an advisor:

--Do you sell a product? If your advisor sells a product, he/she also gets a

commission and may be more interested in lining his pockets than your investment

future. Look for an advisor who is independent - and free to choose from any

mutual fund family, insurance provider, etc., this way you will receive an

unbiased opinion.

--How do you get paid?

Commission – When the advisor invests your money in a certain mutual fund or

investment product, he receives a commission. This will be on top of the mutual

fund’s administrative expenses.

Flat Fees – You may be charged hourly, or at the completion of your financial

plan. The advisor gets paid whether you purchase the suggested investments or

not.

Fee Based – Some advisors will charge a fee based on the percentage of the

assets you have invested with them. This works for both parties because if

assets decrease, the fee is lowered, and if assets increase, your advisor is

fairly rewarded.

--How much exposure in financials did your clients have during the summer of

2007? What, if anything, was done to lessen this exposure and when? When did you

buy into financials?

If the advisor had a large exposure to financials during the summer of 2007, and

did nothing to lessen exposure, he may be an investor who follows the trends,

and does not take profits when the market becomes overvalued. It is important to

know when your advisor initially bought into something, because if he buys as

investments get popular, and are already on the rise, he may just follow the

trends and go with whatever his financial newspaper tells him to buy into. It is

important that an advisor take profits before the market makes another pendulous

swing, and there are no profits left. Wouldn’t you rather have an 8% guaranteed

profit by selling early, than juggle your chances between either a 12% profit or

a 5% loss, depending on when your advisor decides to put his greed aside?

--Do you ever raise cash (take profits) in good times to have the ability to

selectively buy when valuations go down? Another advantage of taking profits

early is that you can buy into quality when valuations go down. If your advisor

sells before the market becomes overvalued, it will plump up your cash position.

Then as the market goes down, such as what we have seen over the past several

weeks, you have the cash available to buy into solid, quality companies at low

prices.

--Do you focus on no-load/low-load mutual funds? Buying into loaded mutual funds

can really take a bite out of your investments.

Click here to visit our Mutual Fund page.

--What are your credentials?

Just as you wouldn’t want your plumber working on your electrical problems, you

don’t want a CPA giving you investment advice. There are a plethora of

certifications and acronyms out there, so be sure that your advisor is qualified

to advise you. Some additional questions:

• How much international and emerging market exposure did you have going into

calendar year 2008?

• If you were in business in 2000, what was your technology exposure for clients

at that time?

• How much cash did your accounts have one year ago, for example, when the

credit crisis was already on investor's radar or in prior extreme times like

1987?

TOP

Under the Microscope:

Focus on Lifestyle or Target-Date Funds

Target-date funds are mutual

funds that claim to be customized to your target retirement

year. As retirement nears, say 2020, the fund holdings become

more conservative and invest more in bonds than stocks. The

concept is simple and given their long term investment horizon

makes sense for retirement plans. Unfortunately, there is a vast

difference among these types of funds that really have yet to

face the scrutiny that is needed to differentiate among fund

families.

Target-date funds are meant to offer convenience, and be

a “one stop shop” for investors planning for retirement.

Sometimes these funds chase performance and may not be in the

best interests of the investor. With a little research, the

investor could pick mutual funds themselves that would be

customized to their specific situation, and their risk level.

These funds have become the default choice in many retirement

plans, replacing the typical money market default option. These

target date funds offer an appealing convenience factor in the

confusing world of retirement investing, but we encourage the

investor to be proactive and choose funds that are in their best

interests, not in the interests of money manager firms looking

to take advantage of ill-informed investors simply looking for

convenience. After all, the average investor, or even 401K

Trustees, is unaware of the new layers of fees inherent on all

of these types of funds. As more and more retirement plan

sponsors use target-date funds as their default options, it is

more important than ever to differentiate fund choices and make

sure they select the fund family that best fits their objectives

and risk profile.

TOP

Financial Follies: Bank

Deposit Rates VS. Money Market Funds

Many financial stocks

continue to establish new multi-year lows despite consensus that mid-March was

the “worst is over” point. At that time, we initiated a 6% position on

financials, after warning about the ripple effects of the financials last

summer. A significant underweight position was still warranted even though

valuations seemed attractive. When there is little transparency in terms of

earnings quality or even in terms of asset quality, we have learned over the

past 28 years that it is best to err on the side of caution. Now that many

financials are trading below mid-March levels, many have asked whether we plan

to add to our modest initial position. The quick answer is not yet for two

primary reasons. First of all, most of the higher quality positions like Goldman

Sachs (buy limit $150) and J.P. Morgan (buy limit $40) have not fallen to new

lows and secondly, the transparency in valuing the questionable assets has not

really improved to any significant degree. It will take more time for the

financial clouds to lift and the general market will still have difficulty

establishing worthwhile new highs until this occurs. In the interim, we would

remain selective and when the markets give investors the opportunity to buy high

quality industry leaders like General Electric and United Parcel Service at

historic low valuations, the smart long term investor should take advantage of

the situation. We recently listed our top holdings along with details as to when

and why we accumulated each position. It was not a coincidence that the only

financial company on our list was Berkshire Hathaway and then only at the #25

position. Not only is Berkshire a very high quality financial that can take

advantage of the dire straits of many of its peers, but just as important most

of our purchases of Berkshire Hathaway were made many years ago at far lower

(last purchased summer of 2006 under $3000 a share) valuations. A little bit of

luck combined with our disciplined research process of taking profits at market

extremes has allowed us to miss much of the financial malaise which has caused

the average investor a lot of pain. Banks, brokerage and investment firms are

all trying to squeeze more revenues for themselves from each and every customer

during these challenging times for the industry. Early this year, we warned

about the Auction-Rate Securities and how their costs & risks were not

adequately disclosed within the selling process to the unsuspecting public. The

latest area that investors should be wary of is in the interest credit within

their brokerage or bank accounts. Many firms are now sweeping new cash from

dividends and deposits into bank deposit accounts rather than the typical money

market funds. Many of these bank deposit accounts yield an average 0.65%

compared to 2.39% for the average money market fund. Investors should pay

attention to any subtle changes within their statements, particularly in regard

to footnotes and other disclosures which may generate earnings to the firm,

unfortunately at the investor’s expense. These switches are automated and many

times not noticed by the average investor. Currently, 16 of the top 20 firms are

using these lower yielding bank deposit accounts.

Last week, we went to an equal weight in the energy sector after a substantial

overweight since 2002. Oil surging to over $130 a barrel, and more and more

investors jumping on the bandwagon was enough for us to recommend locking-in

significant gains. We don’t know if this is the top for energy prices, but we

simply no longer like the risk-to-reward ratio from current levels. We did the

same thing last year when we recommended strategic profit taking in utilities,

REITs, and the financials. Many times we are early with these profit taking

maneuvers like in December 1999 with our research articles that focused on the

overvaluations in the tech arena (these stocks continued to surge another 3-4

months). Even if energy continues to move up, our profit taking now dramatically

reduces risk within our overall portfolios in that we are re-deploying profit

taking proceeds in areas that are more attractively valued and have less

downside. Investors may wish to look at it like we are taking profits now and

possibly leaving some money on the table to avoid potential big losses down the

road. Profit taking proceeds were used to selectively buy in depressed areas

such as technology, healthcare and other high yielding companies with favorable

risk-to-reward over the long term. On the international front we recommend

locking in some partial profits in Russia and would still underweight China

and India. As the following pages detail, we still feel Japan offers the best

risk-to-reward on the planet.

TOP

Auction-Rate Securities - April 2008

Similar to late 1999 when we warned

about the excesses in the technology arena with the dot-com mania, in

May of 2007 we felt that many areas of the U.S. and emerging markets

were over-extended. One of our publications which was printed in early

November 1999 proved early as the NASDAQ continued to surge for several

months thereafter, but investors who did not take money away from the

technology/telecom sectors at the start of this decade were saddled with

huge losses the next 2-3 years. Some favorite areas of investors last

May were once again beginning to get significantly overvalued, resulting

in much higher risk for investors than what was typical at the time.

At the time, staid low growth sectors like the utilities were tracking

the remarkable performance of the Shanghai stock market for the prior

three years. During times like these, the proactive investor must

realize the importance of taking profits and lessening exposure (risk)

in those popular, overpriced areas. After hearing from so many investors

who were burned with overexposure in tech stocks in 2000-2002, we felt

compelled to let even more investors know about our latest words of

warning early last summer when the global markets were still hitting

daily new highs. In June of 2007 we made several national media

appearances in order to discuss, among other items, the importance of

profit taking, especially in overvalued “hot” areas of the market, and

that the ripple effects of sub-prime will be much more pervasive than

investors believe - both in terms of the financial sector, as well as in

affecting the U.S. and global economies.

Just like in 1999 with technology, there were areas where we could have

done even more to protect our client’s assets. We will always strive to

do better and not rest on our laurels. We are confident that more

investors heard our warnings in June 2007 and our emerging market

(particularly China and India) and tech stock warnings in the 4th

quarter of 2007, when all these areas were erroneously hyped by other

experts as ways to avoid the sub-prime mess.

Now as investors are becoming increasingly despondent and worried about

the global markets, we are beginning to find select bargains. It is

comforting to be in a solid cash position into this volatile market,

giving us the luxury to buy into panic selling at significantly lower

prices. Beyond taking profits at all time highs from many exposed

sectors last summer, the cash we built up also was an important factor

in protecting assets over the past six months as most global markets

declined sharply. We are gradually buying into this weakness, resome of

the profits we took earlier. Just like in May of 2007, we still do not

expect to see global markets establish new highs anytime soon. The only

difference is that now values are becoming more attractive, but there

are still too many uncertainties to be fully invested or totally exposed

to the global markets.

A prudent strategy to take advantage of emotional selling and

selectively adding assets to control risk, still is in order. The

madness of March may have brought an end to a majority of the financial

sectors plunge, but getting the sector back to a long term uptrend will

most likely take more time. Again, similar to the over excesses in tech

with dot-com, the financials and real estate areas must pay for many

years of excesses and this will take time. Even if the worst is over for

most financials, the U.S. economy will still have to face difficult

headwinds. Inflation is raising its ugly head, especially in some of the

fast growing emerging markets, and investors are finally realizing that

the global markets are not decoupled from the U.S., so China may face a

very difficult period of stagflation (we brought this possibility up to

investors six months ago) and that is never good for financial assets.

When investors add the uncertainty of the U.S. Presidential election,

growing geo-political risks, and financial markets that are just

awakening to all the ripple effects of the credit crisis, you have a

challenging market that warranted a solid cash position.

We are still seeing new clients coming in that are taking much more risk

and are overexposed in emerging markets and financials - similar to what

we had seen in 2001-2002 in technology. This leads us to believe that it

will still take more time to wash out all the global excesses of the

past seven years. Most of these investors are in a position where not

only do they not understand the risk they are taking, but are just

beginning to realize that they should never have been investing in those

high risk areas in the first place.

Most investors are in for more negative surprises into early 2008. Some

examples we see include conservative investors who are in asset

allocation programs with significant exposure in emerging markets

without fully understanding the consequences. Other investors are

discovering that their auction-rate securities that were sold to them

(Merrill Lynch, UBS, Morgan Stanley were the top three sellers) by many

brokers as a conservative, safe and liquid money market type substitute

are now frozen as the window to redeem these auction rate securities is

closed. Our managed accounts avoided such structured vehicles that were

great in adding fees/commissions (just like the various structured

mortgage type products, hedge funds, SMA’s, etc.) to the brokerage

coffers, but did little to help the investor.

Whether we continue to avoid these traps for investors is impossible to

determine, but we will continue to do our best to avoid these costly

pitfalls. The graphs below show when we took full profits in two

financial holdings for our managed accounts. Our sell recommendation

occurred 12-18 months before these stocks, and the financial sector,

collapsed. This illustrates the importance of a long term perspective

(we were also early in taking profits in the technology sector in 1999)

as investors must look at the complete picture by observing what

happened to these popular and overvalued areas over the subsequent 2-3

years.

Performance of Financials and

REITs through 3/31/08

|

Index |

6/1/07 Price |

3/31/08 Price |

% Change |

|

Dow Jones U.S.

Financials Index

|

608.77 |

410.06 |

-32.6% |

|

Dow Jones Equity All

REIT Index

|

323.13 |

256.31 |

-20.6% |

|

TOP

Biggest Investment Scams According to State Securities

Regulators

- Unlicensed individuals, such as

independent insurance agents selling securities. Scam artists use high

commissions to entice insurance agents into selling investments such as

bogus limited partnerships or promissory notes offering high returns with

little or no risk.

- Unscrupulous stock brokers. It

is bad enough selling class B funds solely to make a higher commission, now

many brokers have been caught issuing phony statements to cover losses from

hundreds of unauthorized trades or even in some cases to use client's money

for themselves.

- Analysts research conflicts.

Regulators continue to probe a dozen brokerage firms to determine whether

analysts based buy recommendations on loser stocks just to win investment

banking business.

- Promissory notes. Short term

debt instruments often sold by independent insurance agents and issued by

little known or non-existent companies. In Georgia amounts scammed reached

$150 million.

- Affinity fraud. Scammers use

victims' religious or ethnic identity to gain trust and steal their life

savings through church "gifting" programs and foreign exchange scams.

N.A.S.D. Disclosure

Plan

Over the past five years

soundinvesting.org has been warning investors regarding the dirty little games

many brokerage firms and mutual fund organizations play in terms of marketing

and compensation. Massachusetts securities regulators recently filed a civil

administration complaint against Morgan Stanley alleging that the brokerage firm

provided incentives to its brokers to sell in-house mutual funds over those run

by outside managers while not disclosing those added incentives to investors.

Among the incentives mentioned in the complaint include Morgan Stanley's entire

compensation system which favors in house mutual funds for both brokers and

their managers. Some outside funds also paid money to Morgan Stanley for access

to brokers in attempts to get them to push their funds. The complaint

highlighted a three month sales contest held in 2002 expressly to boost sales of

Morgan Stanley Funds and funds run by Van Kampen Investments, which is owned by

Morgan Stanley. Sales of these funds are more profitable to Morgan Stanley than

sales of funds run by outside companies. Yet none of those incentives had been

disclosed to clients. These charges are separate from a complaint filed in July

2003 in which Massachusetts accused Morgan Stanley of misleading investigators

about the existence of these types of incentive programs. Unfortunately, such

games are being played by mutual fund organizations and brokerage firms without

investor knowledge. The N.A.S.D. is proposing a potential new industry rule that

would require firms to disclose in writing the nature of certain compensation

arrangements as soon as a customer opens an account or purchases mutual fund

shares. Soundinvesting.org has always stressed to get all costs, risk and

compensation disclosed in writing, from whomever you are working with, before

making any investment. Such transparency is needed in the $6.5 trillion mutual

fund industry and we do not recommend working with anyone that does not fully

disclose such information to you. Mutual funds are not the only ones laden with

such undisclosed conflicts as similar potential problems are seen when buying

individual stocks or bonds. For example, stockbrokers may receive added

compensation to push certain equities, including stocks held by broker/dealers

that it wants to move out of inventory (principal trades). In contrast,

investment advisors must clearly disclose the conflicts in principal trades and

must secure permission in advance from clients. Mandatory disclosure is needed

but for the moment investors must still ask for it in writing. -August 2003

Flirting With Disaster

After a three year decline in

many stock prices we are getting e-mails that state some investors are

simply not opening their brokerage, mutual fund, or retirement plan

statements. One individual even stated their broker told them to not

look at their statements if they are too painful. This procedure could

lead to other problems beyond poor investment performance and we

strongly recommend verifying all activity in each and every statement

promptly upon receipt.

Here are some of the specific

items we would check with each statement:

- Verify the activity in your

account:

- Are there any trades or

cash transfers that you didn't authorize?

- Are the trades reported

consistent with your confirmations?

- Are any cash withdrawals

or additions not accurate?

- Are the size and price

of all purchases and sales correct?

- Are all anticipated

dividend and interest payments reflected?

- Review your account

holdings:

- Are all securities and

cash positions and any debits or credits accurately reflected?

- Does your portfolio

agree with your diversification and asset allocation objectives?

- Confirm basic account

information:

- Are any address changes

accurate?

- Are there any charges or

fees that you don't understand?

- Are any important

changes in your relationship with the firm or your broker

reported?

- Are there any notices

that require a response?

If you do not check your

statements an unscrupulous broker/banker has you exactly where he/she

wants you. This is because without proper notification you lose rights

to correct an error, in many instances within 60 days after the improper

occurrence. In other instances lack of notice will result in delays and

potentially higher costs in your efforts to get things straightened out.

Immediately question any transaction or entry that you do not understand

or that you did not authorize. There are three steps to take if you

find errors. First talk to your broker/dealer and get an explanation

with follow up written confirmation that this will be corrected. Then

make sure on your next monthly statement the adjustment(s) have been

reflected. If you can't resolve the problem with your broker/banker, or

if you think he/she is involved in misconduct (i.e. unauthorized

trades), then report it to the firm's management or compliance

department in writing. Declare a date in your letter (usually 30-60

days) to get this resolved and after that time frame file a complaint

with the

NASD online complaint form.

Two other questionable tactics

that desperate brokers/bankers have been using include:

- Pushing closed end bond

funds with the sales pitch of a 12% yield. Many soundinvesting.org

readers have contacted us before investing in such and did not

realize the risk of the 12% not being guaranteed as well as the

chance of a significant loss of principal. In just one example a

Bear Stearns broker in New York was telemarketing investors in the

Midwest to buy the ACM Government Income Fund, (NYSE - ACM), because

of its current 12% yield. In the current low interest rate

environment a 12% guaranteed return sounds too good to be true and

it is. No mention was made that the fund's yield nor principal were

not guaranteed (the fund actually lost over 10% and 21.7% in 1998

and 1999 respectively). Approximately four out of every five mutual

fund dollars are now going into bond type funds, but investors must

ascertain the risk (and get it in writing) before they invest. Keep

in mind now that interest rates are at multi-decade lows the risk in

bonds and bond funds is significantly greater since higher interest

rates typically lowers the value of your current bond holdings.

- Another technique we find

intriguing is with the performance review that many smart investors

ask their broker/banker to do. Soundinvesting.org found many times

investors are confused with some long term hypotheticals on their

fund holdings in regards to performance. In one instance in Denver,

Colorado, a financial planner gave a client a performance review

with American Funds holdings that showed an 8.94% annual positive

return since 1986. The only problem was the investor was only with

the financial planner the past three years and had losses in each

and every year with said planner. So make sure you receive actual

performance (net of all fees) and not hypothetical when accessing

your investment performance.

SCAMS AND FRAUDS

The huge financial success of the

1990’s has spurned on an unprecedented array of new scams and frauds

aimed at the average investor. Historians will look at the 1990’s as the

golden age of success for investors as well as the advent of

dramatically higher level of financial fraud. It was a decade that a

Canadian gold mining company called Bre-X Minerals Ltd. saw its stock

soar to $4.5 Billion, until its much hyped Indonesian mine was exposed

as a hoax. Fraudulent trading brought down two eminent investment

banking firms in succession Kidder Peabody & Co. and Baring Bros.

The 1990’s finished with would be

insurance mogul Martin Frankel and energetic market guru Martin

Armstrong being arrested within days of each other, each charged by

federal prosecutors for swindling investors out of hundreds of millions

of dollars. In addition, a San Antonio group called InverWorld, Inc. was

accused by the Securities & Exchange Commission of defrauding Mexican

clients of the bulk of their $475M in investments.

While these scandals have

received the majority of the headlines, regulators say the most

devastating fraud for the average investor is the long running epidemic

of small stock scams. They feature pushy telephone salesmen stealing

billions from naive investors each year. Advancements in technology,

including ease of access via the internet, has made scams very

efficient, harder to detect and even harder to prosecute or eradicate.

Many scams align themselves with

religions, educational or charity organizations to gain much needed

credibility. Such an affiliation even if totally fictitious tends to let

investor’s guard down and many times investors don’t follow-up as they

assume credibility (this is exactly why scam artists lie about aligning

themselves with credible institutions). The largest charity scandal of

the 1990’s was at the Foundation for New Era Philanthropy a Philadelphia

charity that promised other charities (again aligning themselves with

credible institutions) and donors that it would double their money

through matching gifts. It turned out that this was simply another

elaborate (well marketed) Ponzi scheme. New Era raised $350M by tricking

prominent people such as Treasury Secretary William Simon, Laurence

Rockefeller, hedge fund pro Julian Robertson and former Goldman Sachs

chairman John Whitehand. New Era’s founder, John Bennett, was sentenced

to jail. So even the sophisticated financial experts have succumbed to

scams, but here are some rules to avoid being trapped.

Three Steps to Avoid

Fraud

- Never make checks payable

to the advisor, advisory firm or broker direct. (A significant

number of cases of fraud can be totally avoided with this one simple

step)

- Investigate your broker

and/or advisor more than you have investigated anything in your

life. (You give them your personal/financial details ask for

theirs. Many brokers and advisors do not want you to see how poorly

they do with their own investments. Ask for the tax

ramifications, risk and total cost of each investment to

be detailed in writing. Double check everything you are told –

start with an online search for past regulatory problems on

http://www.nasdr.com/2000.htm)

- Investigate the custodian

holding your money whether this is a brokerage firm, bank or

broker/dealer. (Check to make sure the entity is in good

standing with N.A.S.D. or banking regulatory agencies.)

Warning signs that

your broker/advisor may not be up to Par

- Great in sales but slack

on details. Once again you should have a good understanding of

your financial situation. Part of their job is to educate so you

totally understand your financial situation as well as your

investment risk costs and limitations. Be aware that in the majority

of the cases the perpetrators are excellent/smooth salespeople.

Familiar statements we have heard from past fraud victims: Well

he/she seemed like a nice guy/gal; I considered him/her a friend; He

seemed to do a lot and was active in our community, our church, or

school, etc.)

- Leaves you in the dark as

to net returns, performance, tax efficiency and risk levels.

This is the most common occurrence (besides fraudulent churning and

unsuitable investments) that clients experience. When you are left

in the dark as far as net return there is probably a good reason.

- Continuous and excessive

advertising/marketing. Many advisors/brokers turnover of

clientele is much greater than they would like to admit so if they

are always marketing and advertising you have to wonder if it is to

replace clients they lost after they learned of better ways.

- Many brokers/advisors align

themselves with schools, community colleges, universities or even

religious groups to gain instant credibility, in addition to gaining

access to an unsuspecting public. Beware of seminars and class

"educational" sessions that are in actuality used for marketing.

It should be noted that in the majority of the cases of fraud – the

perpetrators aligned themselves with credible institutions to gain

access and avoid suspicion.

- Excellent in golf, high

society lifestyle and other extra circular activities. When do

you have time to take care of your clients… many times his/her

lifestyle is from a higher than average debt load or living off of

huge commission over the years. A good barometer is that a broker of

10-20 years or more should show you gains in his/her own portfolio

equal to or greater than his total fee or commissions generated on

both an annual and long term basis. Otherwise that fancy life style

of fast cars and luxurious homes may be from high commissions/fees

ra ther than actual investment success. It is your job to ask if you

are to trust this individual with your money.

- Brokers that recommend

outside money managers for your account. This area has been white

"hot" because this way the brokers just hire a new money manager

(and get a round of new commissions) if your account performs

poorly, rather than actually lose the client. If your broker/advisor

is recommending outside money mangers ask for a list of clients that

he or she has that have actually experienced the returns that are

being illustrated to you. If he/she can not supply you with a

list of actual clients (for whatever reason) then simply go

elsewhere.

Protecting Yourself From The Most Common Scams

It is

important to know the common scams and how they work. Before you cover

the various parts of this website, be aware of these common schemes and

scams:

Pump and

Dump: With pump and dump, owners and promoters of thinly traded

stocks pump up the value by hyping them, or using bribes and threats to

get brokers to do their dirty work. Suckers buy. The crooks sell at a

peak and then short the stock. The price plummets. The suckers are left

with a huge loss. This con works best with stocks that are thinly

traded, because the prices of these stocks can be manipulated more

easily than those of securities that are more widely held. As with most

cons, the pump and dump can easily be modified for the Internet. Crooks

can post misleading messages to bulletin boards, create phony Web

newsletters, and produce bogus press releases. In fact, some of the

techniques they've developed are very slick indeed, so you need to be

more wary than ever.

The

Boiler Room: Here, crooks sit and 'cold call' you, your neighbor,

anybody - to pitch 'can't miss,' risk-free,' 'high-flying' investments.

Here's how the SEC describes a typical boiler room operation:

'Unregistered salespeople, working from various offices in lower

Manhattan, cold-called investors using a high-pressure sales pitch that

included numerous material misrepresentations and omissions. The

defendants used mail drops and telephone forwarding services so that

investors would not know their actual location. The unregistered

salespeople were paid undisclosed cash commissions of approximately

30%.' According to the SEC, 'Aggressive cold callers speak from

persuasive scripts that include retorts for your every objection. As

long as you stay on the phone, they'll keep trying to sell.' Now,

sometimes the cold call multiples into cold calls-plural. They warm you

up in the first call, trying to create trust. Second, they set you up by

whetting your appetite for this great deal they can supposedly get for

you (as if they were doing you a personal favor). And then, the third

time, they close the deal - telling you to buy now or miss out.

Plain

Old Hype and Misrepresentation: In a recent case cited by the SEC,

hucksters solicited investors by telling them the company was going to

acquire and operate funeral homes. Not a very sexy business. But a

lucrative one. After all - there's always going to be steady demand for

their services. Representatives of the company claimed they had already

acquired several funeral homes. Not true. They even hooked an

institutional investor, saying there were other, more sophisticated

investors involved, and that they themselves had money in the company.

Using these tactics, this company raised more than US$4.3 million from

56 investors. The problem is, the company did very little burying.

Rather, its officers shifted the money to other ventures - and their own

pockets. Needless to say, the company is now six feet under and the

investors' money went up the chimney. The ultimate misrepresentation is

selling a company that does not exist. Fictitious microcap stocks are

particularly easy to create, because there's less press coverage about

microcaps in general, and fewer filing requirements. Sometimes the

misrepresentation isn't quite criminal, just excessive hype or

'puffery.' Even so, you should always be on the alert for misleading

company press releases. Editor's note: A good example of the damage that

deliberately phony information can do to a company's stock price: Last

week's fraudulent press release on Emulex, which sent the company's

shares plummeting and investors' bailing - and resulted in the quick

arrest of the perpetrator.

Phony

Inside Information: It's illegal to trade when you have genuine

inside information about a company. While it's not technically a con,

trading on real inside information can get you into serious hot water.

But when information is leaked to make you think it's inside

information, and it's not, you're not a criminal. You're just a sucker.

Bait and

Switch: Scamsters will lure you in by encouraging you to buy

well-known, widely traded blue chip stocks. Then they pressure you into

investing in smaller, lesser-known stocks as well.

Churning: Among unscrupulous brokers, churning is one of the oldest

tricks in the books. The broker simply keeps buying and selling stocks

to create hefty commissions for himself.

Outright

Theft: Lest you believe you're too smart, too sophisticated, too

worldly to get hoodwinked, think again. just take a look at this hot new

scandal in Hollywood, home of glamorous stars and sophisticated agents.

A well-known broker has apparently bamboozled big name stars out of more

than US$9 million. A 37-year old Wall Street professional, whose clients

included Leonardo DiCaprio, Courtney Cox Arquette, Cameron Diaz and Matt

Damon, pleaded guilty to raiding client accounts to pay for his lavish

lifestyle. This was a simple ponzi scheme, where he used funds from one

client's account to make up for money he stole from another client. He

even falsified statements. Now, these are people who can afford the

best, most expensive advice there is. And still they got their

gold-lined pockets picked. There are many more scams than these; in

fact, the list is virtually endless. But you get the idea. These guys

are coming at you from all directions, and now you know something about

the threats they pose."

NASDAQ

Bulletin Board and Pink Sheets

In early March 2000,

soundinvesting.org was fortunate to have warned our readers about the

extreme valuations in many speculative high technology stocks,

particularly in the internet arena (see FAQ section). Since then, we

have heard many disastrous real life examples of the effects of

investing in such stocks, many portfolios unfortunately using margin. To

go back to our thoughts on margin you have to listen to legendary

investor Sir John Templeton who simply stated that under no

circumstances should an investor borrow money to buy stocks. Another

area that is far overexposed that investors don't underst and the risk

is h are already bankrupt, which has exceeded over one billion shares a

day. These illiquid stocks are not regulated, and therefore, often times

attract dishonest investors that seek to take advantage of illiquidity

to manipulate stock movements. Pink Sheet stocks have even less

reporting (no volume figures whatsoever) and believe it or not are even

more speculative. These stocks often have dramatic run-ups giving the

illusion of success and tremendous money being made - just don't be left

holding the bag because most often these moves are very temporary in

nature.

- NASDAQ: Used to stand

for National Association of Securities Dealers Automated Quotation.

Today, the official name is NASDAQ stock market.

- NASDAQ National Market:

Part of the NASDAQ Stock Market. It lists stocks of more than 4,400

companies. These companies meet its most stringent listing

requirements, including a $1 minimum bid price, more than $4 million

in tangible assets, at least 750,000 publicly available shares

(float) and 400 shareholders.

- NASDAQ SmallCap Market:

Part of the NASDAQ Stock Market. It lists stocks of nearly 1,800

companies. Listing requirements include a $1 minimum bid price, more

than $2 million in tangible assets, at least 500,000 publicly

available shares (float) and 300 shareholders.

- Over the Counter Bulletin

Board (OTC:BB): Owned by NASDAQ but completely separate in

operation. It includes more than 6,500 stocks that do not meet

NASDAQ requirements. It does not provide automated trade execution

like NASDAQ and it imposes fewer requirements on its market makers

(the people who execute trades). It does not impose listing

requirements but the SEC is in the process of implementing some

financial reporting requirements on OTC:BB traded companies.

There are three areas that the

SEC is beginning to crack down on regarding these illiquid

NASDAQ securities:

- Market Manipulation

(also known as :pump and dump" schemes) involve persons attempting

to inflate the price of a stock illegally. the scam artist may, for

example, post fraudulent information on messages boards or in chat

rooms to boost a stock's price. In one case that the SEC prosecuted,

two former UCLA students and a third defendant succeeded in hyping a

thinly traded stock to raise its price from 13 cents to $15 in a

single trading day.

- Offering Frauds are

false offers to sell things. The SEC has gone after bogus sales of

interest in eel farms, coconut plantations, even a new underwater

city. There also has been an increasing incidence of Ponzi and

pyramid schemes, which pay off early investors with the money

received from later entrants. The SEC is also increasingly concerned

about the potential for affinity fraud on the internet.

- Scalping is the

practice of touting a company's shares for money without disclosing

the compensation and may be accompanied by the touter's sale of

shares as the price rises.

Investors Beware

There may be something about seeing information on a computer screen

that makes it seem more valuable, more reliable. But people don't

usually accept investment suggestions from random strangers whom they

meet on the street; nor should they accept without skepticism

information received from strangers on the internet.

This is not to suggest that the

SEC is opposed to the emerging role that the Internet is playing in

investment management. To the contrary, the agency applauds the greater

access to financial information and investor education that the Internet

has brought. Future SEC initiatives in the area of full investment

disclosure are likely to rely heavily upon use of this medium.

But in getting investment

information from the internet, a little common sense will go a long way.

In relying on information from the internet it is critical to be wary

especially when it comes to advice on smaller illiquid stocks that can

easily be manipulated.

|